SHFE & Market today: May the 8th

Important facts about today’s Market:

- China Trade Balance (USD) rose to actual 38.05B while forecast was 35.50B

- China Imports y-o-y fell to actual 11.9% while expected was 18.0%

Shangai Futures Exchange:

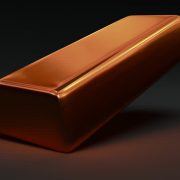

Copper price slided during Asian morning trading hours on Monday May 8. The performance of red metal was weaker, as well as the contracts on the London Metal Exchange.

“The pull-back of SHFE copper prices this morning was mostly impacted by the weakness in LME copper prices. This was a result of a build-up in LME copper inventory last week.” (Metal Bulletin)

The three-month copper contract on the LME was 0.98% or $55 per tonne lower as of 03:19 BST.

LME copper inventories were the highest since October 2016. They rose a net 36,800 tonnes to 354,650 tonnes on Friday May 5. This followed rises of 32,925 tonnes and 31,250 tonnes on May 4 and 3, respectively.

SHFE Copper tracks LME prices lower:

Firstly, LME copper inventories rose a net 36,800 tonnes to 354,650 tonnes on May 5. Secondly, deliverable copper stocks at SHFE-approved warehouses dropped 14,130 tonnes or 6% over the past week to 215,231 tonnes on May 5.

“The fall down in SHFE copper stocks was happening due to the dip-buying from consumers. Anyway, as the copper price continued to hover at a low level. This made market participants show doubts as to whether the real demand could support the expanding inventories within consumers.” ( analyst from Guotai Jun’an)

“The fall down in SHFE copper stocks was happening due to the dip-buying from consumers. Anyway, as the copper price continued to hover at a low level. This made market participants show doubts as to whether the real demand could support the expanding inventories within consumers.” ( analyst from Guotai Jun’an)

Secondly, In supply news, Glencore reported lower copper production during the first quarter of the year due to its Antamina operation. The miner’s copper output reached 324,100 tonnes during the first three months of the year. It is a decline of 3% compared with the corresponding period of 2016.

Nickel prices jump off on immerse-buying:

Thirdly, SHFE September nickel price soared 920 yuan to 73,920 yuan per tonne.

“The rally in nickel prices this morning was mainly a result of dip-buying following the falls seen last week.”

Following, last week saw nickel prices come under pressure amid the expectation of increased supply after the Philippines’ Commission on Appointments rejected Regina Lopez’ appointment. As the country’s environmental secretary. Lopez and her strict crackdowns on the Philippine mining industry were loosely regarded as important factors in keeping laterite ore export volumes from the Philippines low. Once the rainy season in the country had finally ended.

Aluminium prices slide down on rising stocks:

Speaking about Aluminium prices, the SHFE June price slipped to 13,755 yuan per tonne as of 03:18 BST. It is down 125 yuan from the previous session’s close. In addition, aluminium stocks rose 12,327 tonnes to 403,905 tonnes on May 5.

“Aluminium is still consolidating after recent price jumps. Moreover, the market might be waiting in anticipation [of better prices] following aluminium supply-side reforms [in China. However, chances are that the actual deficit might not be as large as people expect.”

“Aluminium is still consolidating after recent price jumps. Moreover, the market might be waiting in anticipation [of better prices] following aluminium supply-side reforms [in China. However, chances are that the actual deficit might not be as large as people expect.”

Currencies & Data:

The Brent crude oil spot price rose 0.67% to $49.73 per barrel while the Texas light sweet crude oil spot price was up 0.69% to $46.78. Following, the dollar index was up 0.16% at 98.74 on Monday as of 03:18 BST.

In equities, the Shanghai Composite dipped 0.61% to 3,083.99.

- US unemployment claims for April came in at 238,000, below the forecast of 246,000. Preliminary non-farm productivity and unit labour costs during the first quarter came in at -0.6% and 3%, respectively.

• China’s April yuan-denominated trade balance stood at 262 billion yuan, beating both the forecast and the previous month’s balance of 197 billion yuan and 164 billion yuan, respectively.

• While the country’s dollar-denominated trade balance for April stood at $38.1 billion, exceeding expectations of $35.3 billion and March’s balance of $23.9 billion.

• UK Halifax house price index and BRC retail sales, EU Sentix investor confidence and US labour market conditions are due.

The EURO hit a seven-month high against the dollar after Emmanuel Macron won yesterday’s elections. This is a victory that should further boost the currency, as political concerns fade, and investors focus on the eurozone’s economic recovery.

Leave a Reply

Want to join the discussion?Feel free to contribute!